Understanding the Different Types of Audit Reports

Different Types of Audit Reports

Audit reports play a crucial role in ensuring financial transparency and compliance for businesses. Conducted by external auditors, these reports assess a company's financial statements for accuracy and adherence to regulations like GAAP. There are four main types of audit reports: unqualified (clean), qualified, adverse, and disclaimer of opinion—each indicating varying levels of financial accuracy and compliance. Key components of an audit report include the auditor's opinion, responsibilities, basis for

The function of auditing is vital within finance and business, as it aids in the creation of financial statements that are lawful, thorough, and free from significant discrepancies. An audit consists of an external review performed by a qualified auditor, who examines a company's records to formulate a financial statement. The primary aim is to confirm that the financial statements truthfully depict the company's financial condition and comply with relevant regulations.

What is An Audit Reports?

An audit report constitutes a formal evaluation issued by an internal or external auditor concerning a company's financial statements. It assesses the extent to which these documents, including the balance sheet and income statement, truthfully depict the company's financial status. This assessment holds significant importance for investors, creditors, and other parties who utilize these statements for decision-making purposes. The report is based on the auditor's detailed analysis of the company's financial records. In an ideal scenario, the report will present a "clean" opinion, signifying accuracy; conversely, it may uncover issues, leading to a qualified or negative opinion.

Purpose of An Audit Report

The primary function of an audit report is to provide an assessment of a company's financial health concerning its financial statements. Annual audits promote transparency in corporate financial reporting, which is essential for fostering positive relationships between companies, their investors, and the public at large. The audit report reflects a company's financial results for a particular fiscal year and assesses its compliance with standards such as GAAP. Investors carefully evaluate audit reports, using the insights gained to guide their investment decisions. Furthermore, regulators analyze these reports to ascertain whether penalties for noncompliance are warranted.

Types of Audit Report

Audit reports can be classified into four types, with each type delivering different conclusions based on the auditor's evaluations. Understanding the different types of audit reports is crucial as these reports are fundamental in expressing the reliability and accuracy of a company's financial statements.

Unqualified Audit Opinion (Clean Report)

An unqualified opinion, commonly termed a 'Clean Report,' is the primary form of audit report. This denotes that the auditor has assessed the company's financial statements and determined that they are free from any misstatements and comply with generally accepted accounting principles. Thus, the financial health of the company is now accurately conveyed without any qualifications. The company is now able to present this report to the public, which is a positive indication of its growth, overall confidence, and sound financial reporting practices.

Qualified Report

A qualified report conveys an auditor's opinion regarding a company's financial condition, indicating that the organization has not fully adhered to the standards established by GAAP. However, this does not imply that the company is engaging in illegal activities or misrepresenting its financial practices. The issuance of a qualified report signifies that the company must fulfill specific criteria to have its financial status validated by auditors. Auditors may provide this report when there are uncertainties surrounding particular business transactions or practices. Within the qualified report, the auditor outlines the qualifications that the company must address to ensure compliance with GAAP. Such reports assist financial management teams in identifying areas within the company that require improvement to enhance its financial standing.

Adverse Opinion

An adverse opinion represents the most critical form of audit report, signifying that the financial statements are marred by both significant and widespread inaccuracies. Such a report can lead to severe repercussions for a company, including harm to its reputation and potential legal issues. Adverse opinions may stem from unintentional errors or fraudulent conduct. Should illegal activities be revealed, corporate executives could be subject to criminal prosecution. Without remedial measures, investors and regulators are likely to dismiss the company's financial statements, necessitating a re-audit following the implementation of corrections.

Disclaimer Of Opinion

The issuance of a disclaimer report is a direct consequence of a disclaimer of opinion. When auditors deliver a disclaimer of opinion report, it signifies their withdrawal from offering any judgment concerning the financial statements. This type of disclaimer is widely regarded as a stringent measure, which can tarnish the company's reputation. Auditors might issue a disclaimer of opinion for several reasons, including perceived limitations imposed by the company on their auditing capabilities or inadequate responses to their inquiries. They may also find it challenging to interpret the true nature of certain transactions or to gather enough evidence to support reliable financial reporting. In instances where auditors are denied the opportunity to observe operational practices or examine specific procedures, they may feel compelled to issue a disclaimer as they cannot confidently express an opinion.

Components of An Audit Report

Auditors have the flexibility to modify the format of their audit reports to align with their individual requirements and preferences; however, they frequently utilize a common template. The report typically commences with a heading that indicates the date, the auditor's name, the name of the company, and the corresponding address. The main body of the audit report generally comprises the following sections:

Auditor’s Opinion

The auditor provides a summary of the company's financial status and categorizes their report as either clean, qualified, disclaimer, or adverse opinion. Additionally, they will outline essential information pertaining to the audit process, including the company's name, the duration of the audit, the financial documents reviewed, and a declaration regarding the company's compliance with GAAP standards.

Auditor’s Responsibility

Auditors have a legal obligation to articulate their responsibilities in assessing the financial condition of the organization. They are required to clarify the methods they will employ to ensure that their findings are impartial and free from any personal biases.

Basis For Opinion

This is the point at which the auditor will convey the basis for their opinion. They will describe the various evaluations utilized in the review process, conformity with GAAP regulations, and the findings from the tests conducted.

Other Responsibility

This section provides auditors with the opportunity to indicate particular irregularities observed in financial reports or to recommend subsequent actions that may facilitate improved evaluations in the future. It is essential to recognize that this section is optional and is particularly unnecessary for reports that are without issues.

Signature

The official signature of the auditor authenticates the audit report as a credible document. Moreover, this section includes the city where the audit was performed and the date of the signature.

Audit reports serve a purpose beyond mere formalities; they offer critical insights into a company's financial condition and operational methodologies. By comprehending the various types of audit reports, businesses and stakeholders can evaluate risks, recognize potential issues, and make well-informed decisions grounded in the company's financial statements.

If you are looking for a reputable audit firm or seeking professional audit services in Dubai, having a fundamental understanding of the different types of audits can be highly beneficial. Knowing the various audit types will help you make informed decisions, choose the right service for your business needs, and ensure compliance with financial regulations. Whether it's an internal audit, external audit, or compliance audit, understanding their purpose and scope can give you a strategic advantage in managing your financial processes effectively.

Related Blog

AC Maintenance Tips from UAE Repair Experts

How to Prepare for the GMAT: A Step-by-Step Guide

68ec9e22634a4.png)

10 Tips for Choosing the Right ERP Solution

Common Problems with CPVC Pipes and How to Avoid Them

The Importance of SAT Practice Tests for SAT Preparation

Common Mistakes to Avoid When Purchasing Air Dryers

Gmat Exam Preparation Tips From Top Tutors In Dubai

Trusted suppliers of pvdf ball valves in uae - what to look for

How Ucat Classes Help Improve Your Cognitive Skills

Electric vs Diesel Compressors: What's Best for UAE Conditions?

Cables For Automotive Industry: What Makes Them Different?

How Ap Chemistry Tutoring In Dubai Boosts Exam Confidence

Top 10 Citizenship by Investment Consultants in the UAE

Benefits Of Using Glass And Aluminium In Modern Construction In Uae

Top Benefits Of Joining Ib Maths Tutoring Classes In Dubai

How To Choose The Right Battery For Your Vehicle In The Uae

How To Choose The Right Cable Manufacturer For Your Business Needs In Uae

Role Of Mock Tests In Gmat Preparation: Insights From Dubai Experts

How to Choose the Best Courier Service for Your Business Needs

Top signs your car battery needs replacement in UAE

The Importance Of Cleaning Your Ac Filters: Tips For Better Air Quality

5 Tips to Find the Best Personal Trainer in Dubai

Best Car Repair Shops In Al Quoz

Top Water Meter Suppliers in the UAE

Best SAT Centers in Dubai

Common Causes Of Tyre Damage And How To Avoid Them

Top Cardiology Hospital in Dubai

Top homeopathic clinic in Dubai

Top 5 Flow Meter Suppliers in UAE

Top 5 Pipe Fittings Suppliers in UAE

68edf1fee9090.jpg)

Tips To Minimize Expenses In Your Business

Top 7 Budgeting Tips for International Students in Australia

10 Best Car AC Repair Centers In Dubai

Top 10 dermatology Hospitals in Dubai

Top 10 courier service companies in Abu Dhabi

Top 8 Luxury car service centers in UAE

Common Myths and Misconceptions about IVF Treatment in Dubai

Top 10 Managed IT Service Providers (MSPs) in the USA

Best Car Tyre Brands for Dubai's Road Conditions

10 Best Pirelli Tyre Shops In Dubai

Top 7 Car Tyre Shops In Dubai

5 Common Mistakes Small Business Owners in UAE Make in Their Bookkeeping

Top 5 IVF Clinics in Dubai For Your Journey To Parenthood

KOC Project of Visual Flame Detection Systems

Top 10 Car Repair and Maintenance Services in Dubai

Top 15 Business Setup Consultants in Dubai

Top Ten Car Service Companies In UAE

68f0a0f5a49dc.png)

Top FIT OUT Companies in Dubai

Top 10 Manpower Supplying Companies in UAE

Top 10 GSuite Resellers in Dubai

List of Best Custom Website Development Companies in Dubai

Top 15 Company Formation Consultants in UAE

Top Hyperbaric Oxygen Therapy Centres In UAE

Top Control Room Solutions Providers in UAE

Top 10 accounting and auditing firms in Dubai, UAE

Top 10 Orthopaedic Hospitals in Dubai

UAE's Online Business Listing Directory Websites

Online Learning Platforms for Students

List of Web Designing Companies in Dubai

Study Abroad Destination: How To Choose the Right Country

9 UCAT Exam Tips For Success

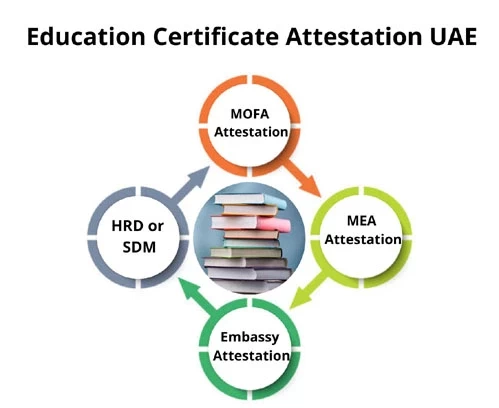

Importance of Educational Certificate Attestation in UAE

Benefits of Implementing Electronic Document Management System

Procedures To Be Fulfilled By A Foreigner To Start A Business In Dubai

What Is The Importance Of Attesting Educational Certificates In UAE?

Deep Cleaning Services in Abu Dhabi

List of e-commerce development companies in Dubai

Top 10 social media marketing agencies in Dubai

Top Water Purifier Brands in UAE